By Craig DiLouie, LC, CLCP, education director for the Lighting Controls Academy.

The Conference Board’s latest forecast estimated that U.S. real gross domestic product (GDP) declined from 2.7% in 2024 to around 1.9% in 2025, reflecting the negative impacts of tariff policies and buoyant effects of AI investment and softening but resilient consumer spending. The think tank projects GDP will slow to 1.5% in 2026 as tariff effects deepen and consumer spending further softens.

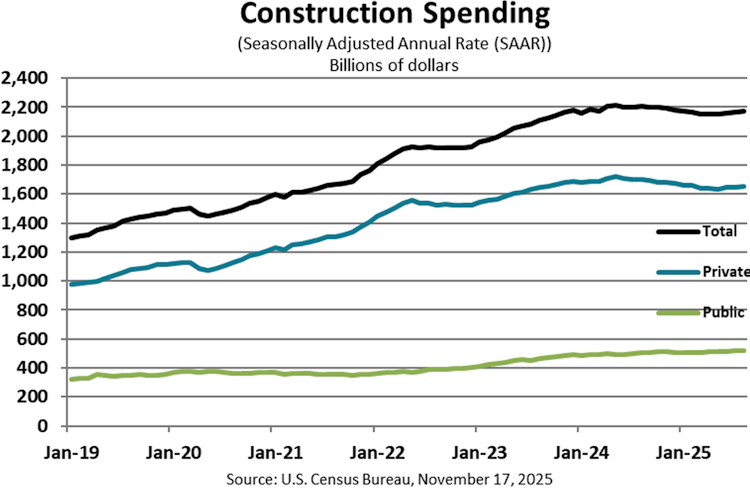

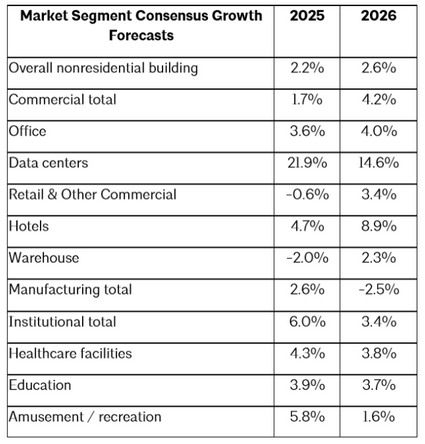

A major contributor to the economy is construction, which overall cooled in 2025 after strong growth of 6.5% in 2024. During the first eight months of 2025 for which data is available, construction spending amounted to $1.438 trillion, 1.8% below the same period in 2024. Overall, the American Institute of Architects (AIA) Construction Consensus Forecast Panel, made up of leading economic forecasters, projects 2.2% growth in 2025 that modestly increases to 2.6% in 2026, with a key driver continuing to be high-value data centers and megaprojects (>$1 billion).

A major contributor to the economy is construction, which overall cooled in 2025 after strong growth of 6.5% in 2024. During the first eight months of 2025 for which data is available, construction spending amounted to $1.438 trillion, 1.8% below the same period in 2024. Overall, the American Institute of Architects (AIA) Construction Consensus Forecast Panel, made up of leading economic forecasters, projects 2.2% growth in 2025 that modestly increases to 2.6% in 2026, with a key driver continuing to be high-value data centers and megaprojects (>$1 billion).

“The modest outlook is partly based on a few expected headwinds to building activity, including potential tariffs on imports,” said AIA Chief Economist Kermit Baker, PhD. “There is also policy concern around how the construction labor force might be impacted by emerging immigration policy. Construction sector spending has been exceedingly strong—albeit unusually unbalanced—and coupled with these headwinds the projections are only very modest gains the next two years.”

This article reviews 2025 construction spending and key industry economic indicators, with a detailed 2026 forecast by the AIA Consensus Forecast Panel.

2025 Construction Spending

Construction spending during August 2025 was estimated at a seasonally adjusted annual rate of about $2.17 trillion, 1.6% below the August 2024 estimate of about $2.2 trillion.

Spending on private construction was estimated at a seasonally adjusted annual rate of about $1.65 trillion, with residential construction at $914.8 billion and nonresidential construction at $737.3 billion. Spending on public construction was estimated at a seasonally adjusted annual rate of $517.3 billion.

According to the AIA, spending on institutional facilities is projected to see the strongest gains of 6% in 2025 while commercial construction spending is expected to increase by 1.7%.

Dodge Construction Network

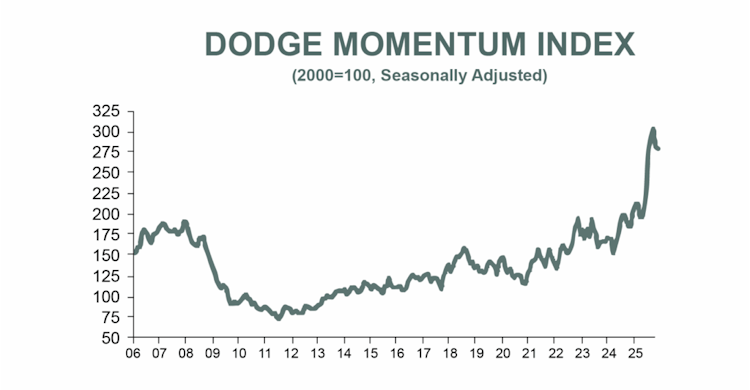

Issued by Dodge Construction Network, the Dodge Momentum Index (DMI) decreased 1.1% in November 2025 to 276.8 from the downwardly revised October reading of 280.0. The DMI is a monthly measure based on the three-month moving value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year to 18 months.

Over the month, commercial planning ticked down 0.1% and institutional planning declined by 3.4%. Year-to-date, the DMI is up 36% from the average reading over the same period in 2024, however.

“The influx of high-value data center work, compounded by inflationary cost pressures, continues to support elevated DMI levels,” said Sarah Martin, Associate Director of Forecasting at Dodge Construction Network. “Overall, nonresidential construction is expected to strengthen in 2027, led primarily by data center and healthcare projects. Other nonresidential sectors are more likely to face softer demand and heightened macroeconomic risks.”

On the commercial side, activity slowed down for warehouses and hotels, while planning momentum was sustained for data centers, traditional office buildings, and retail stores. On the institutional side, education, healthcare, public and recreational planning saw weaker momentum after strong activity in recent months. Planning for religious buildings, however, continued to accelerate.

Architecture Billings Index

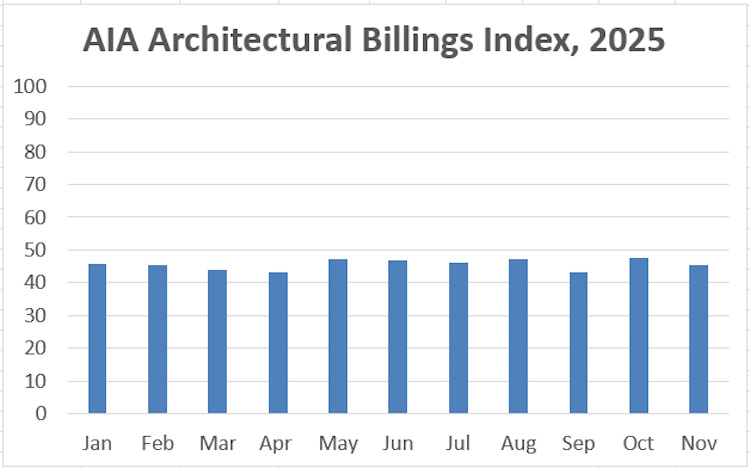

The AIA/Deltek Architecture Billings Index (ABI) is a leading economic indicator of construction activity, providing an approximately nine- to 12-month view into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients. A score above 50 indicates expansionary business conditions. Below 50, contractionary conditions.

The ABI score for November 2025 was 45.3, marking the 13th consecutive month of declining billings at architecture firms, and the 35th month of a score below 50 out of the last 38. Inquiries into new projects increased modestly that month, and the value of newly signed design contracts continued to soften.

“Weakness in business conditions at architecture firms continues to be widespread, with declining billings across all major specializations and in every region except the Midwest,” said Baker of the AIA. “However, inquiries for new projects continued to increase, and design activity at firms in the Midwest—a region that traditionally has had a disproportionate share of manufacturing activity—appears to have hit its bottom for this cycle and is expected to continue to improve.”

Electrical industry confidence

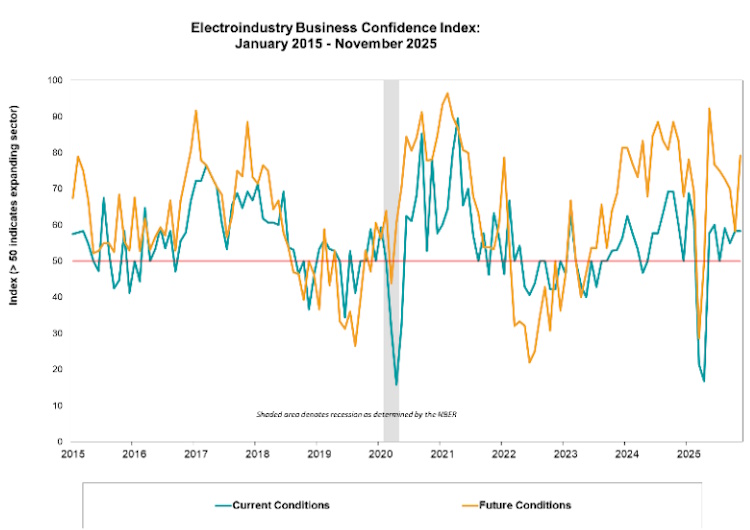

Posted monthly by the National Electrical Manufacturers Association (NEMA), the Electroindustry Business Confidence Index (EBCI) pulled back sharply in March and April 2025 due to economic uncertainty and tariff policy but rebounded in May. For the rest of the year, the EBCI reflected positive current conditions.

In November, the Current Conditions component held steady at 58.3, a score indicating conditions favorable to growth, while the Future Conditions component surged to a strongly optimistic 79.2, with panelist comments showing concern over slowing consumer activity but noting better clarify on tariff policy and strong orders in key markets.

AIA Consensus Forecast for 2026

AIA Consensus Forecast for 2026

Representing the leading construction forecasters from across the country, the panelists in the latest AIA Consensus Construction Forecast expects gains of 2.2% in nonresidential construction spending activity in 2025 and 2.6% in 2026, an overall modest outlook.

Highlights from the forecast:

• Data centers enjoyed extraordinary growth in 2025; while spending is expected to slow in 2026, it remains a bright spot in the market.

• Despite overall weakness in the office building market, an increase is projected in both 2025 and 2026 due to strong spending on data centers.

• After years of strong growth, construction spending in the manufacturing center slowed in 2025 and is expected to decline in 2026.

• Warehouse construction, which has driven retail and commercial growth, slowed in 2025 due to overbuilding in many regions but is expected to return to modest growth in 2026.

• Retail and other commercial construction are expected to rebound to growth in 2026.

• Major institutional sectors like healthcare and education, which are less vulnerable to boom-and-bust patterns, are expected to continue to see growth, albeit at a slower rate.

• The AIA expressed concern that modest increases in construction spending may not cover rising material and labor costs, which may result in little impact on construction volume.